Rebates, Drawbacks and Refunds on Imports into South Africa – How you can save money

As a foreign business entity based in South Africa, you may benefit from understanding and making use of the import rebates, drawbacks and refunds made available by the South African government. Your South African-based business could qualify for these benefits if it manufactures, processes or packages products containing imported material. Should the products you require for production be inaccessible at fair prices in South Africa, the South African government allows for nil or reduced import duties on those items. Importing for this reason would encourage local production, and thus drawbacks or rebates on the imports are approved. In addition, if your imports are deficient or damaged, you could apply to South African Customs for refunds on the duties and VAT (Value Added Tax) you paid. Rebates and drawbacks have two objectives:

- to encourage the local South African manufacturing trade by removing or reducing duties on certain raw materials that are imported for use in production.

- to encourage South African exports through the removal, reduction or refunding of duties on specific goods, thus enabling those South African processors, packers and manufacturers who plan to produce goods for export, to export at more internationally competitive prices.

The South African Customs and Excise Act No. 91 of 1964 (subsequently referred to as the Act) allows for duty and VAT rebates and drawbacks.

Understanding Rebates

A rebate is a total exemption or partial reduction of import duties, dependent on the importer’s observance of specific conditions as detailed in the Act, at the time of import. Each rebate item has its own degree of rebate. Products that pass for rebate are listed in the Act under these headings: Schedule 3 (industrial rebates),

- Schedule 4 (general rebates), and

- Schedule 6 (excise duties, fuel levy, and environmental levy)

To qualify for rebates, importers are required to have a dedicated rebate store in which the rebate goods are kept safe. The store must be situated in South Africa and registered with South African Customs. This rebate store must be separate from a bond store. It must have its own security set-up. For example, the secure area should have a single lockable entry with space on the gate for a Customs lock.

Understanding drawbacks

When the importer pays customs duty to obtain specific materials for use in processing, packaging, or manufacturing goods for export from South Africa, that importer is eligible for a refund of the customs duty. This refund is called a drawback. Products that pass for drawback are listed in the Act under the following heading in the South African tariff book:

- Schedule 5

The importer initially pays full duty tax when bringing the goods into South Africa. However, you can claim this all back from South African Customs at the time that those goods are exported as part of a final product. Making the drawback application after processing the imported goods enables you to establish more clearly how much of the import was used to manufacture your final product for export. For instance, an importer might use a portion of the raw materials to manufacture products to export, while selling the remaining materials locally. Another scenario is where an importer does not know that they will use the imported goods to manufacture products for export.

Note: The drawback application may only be submitted following the export of the final product. Proof of export must be affixed to the application. The accurate customs procedure code (CPC) and drawback item must be shown on all export declarations before the export of the products from South Africa. These applications must be submitted within 6 months of the date of export.

Understanding refunds

As an importer into South Africa, you can apply for refunds from South African Customs in cases where you export a product that remains unchanged since importing, or where you can demonstrate that you paid levies or duties that were not due you.

It is appropriate to apply for refunds in the following situations, according to South African Customs:

- The importer overpaid on a duty;

- There was a miscalculation in the price;

- Before release from Customs, the imported items were lost, damaged or destroyed by circumstances out of the importer’s control;

- The wrong tariff classification was used on the import;

- The products were short-landed, short-packed or short-shipped either partially or in total.

- Duties that applied to the import were minimised or removed;

- The substitution of any bill of entry in terms of section 40 (3) of the Act.

Note: Refund applications must be made within 2 years from the date on which the fee to which the application refers was paid, or within 2 years of the products being cleared by Customs.

Do my products qualify for rebates and drawbacks?

The products should qualify for rebates or drawbacks where the importer can ensure that the following requirements are met:

- The imported products are listed in the South African customs schedule as qualifying for rebate or drawback;

- The products are being used as per the particular use specified in the customs schedules.

- The importer is registered with South African Customs as a rebate user and, where needed, has the relevant ITAC (International Trade Administration Commission)

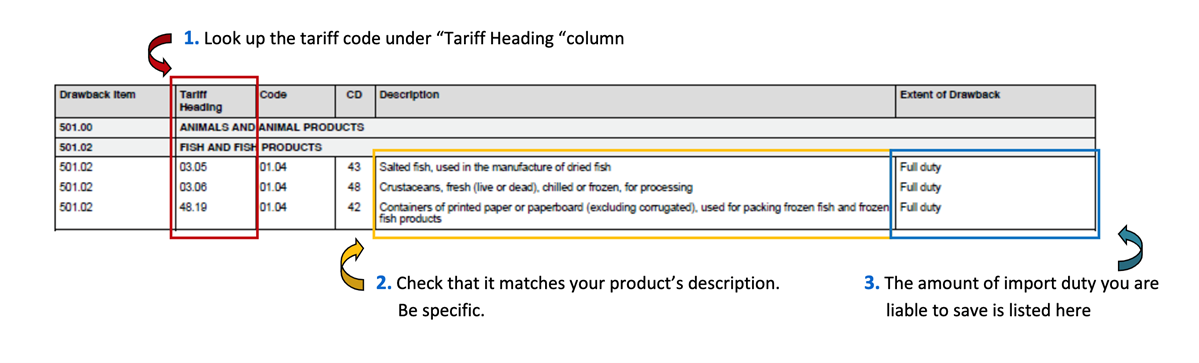

To make it easier for you to determine the extent of the rebate or drawback you could claim, our website has copies of Schedules 3-6 under ‘Rebate, Drawback and Refund look up’. You simply require the tariff code of the imported item. Open or download the guide, press CTRL+F (or CMD+F for Mac users) to open the search bar in the PDF, and type your tariff code into the search bar. Ensure that the guide’s product description matches the tariff heading you entered. Check the end column to see whether your item qualifies for a rebate or drawback.

Image 1: Using the lookup guide for rebates, drawbacks, and refunds.

Open drawback, rebate and refund lookup tool

Note: It is imperative that the imported item be used for the purposes set out in the guide, otherwise the drawbacks or rebates under the schedules in the guide will not be issued by South African Customs. For instance, in Image 1, drawback item 501.02 is listed as “containers of printed paper or paperboard (excluding corrugated), used for packing frozen fish and frozen fish products”. If the importer does not use the paper or paperboard specifically to package frozen fish products, they will not qualify for a drawback.

Understanding when your product isn’t in the schedules

Although the products you wish to claim for are not listed in the schedules currently in use, South African Customs might consider them for rebate if they were included in manufacturing, finishing, packing or processing items to sell, or if they were used as equipment in the processes mentioned. Additionally, you could qualify for a drawback if those produced items were for export sale. Under this condition, your application for a drawback or rebate permit must be lodged with ITAC.

Further help needed? Should it still be difficult to locate your imported item on the current customs schedules, let us help determine whether it qualifies for a rebate, and assist with the application for the necessary ITAC permit. Get in touch for more information.

Understanding why your refund or drawback might not be approved

South African Customs may deny your refund or drawback application when:

- the application wasn’t lodged within the specified time frame;

- customs duties and taxes were paid on fraudulent items that were destroyed;

- customs duties and taxes were paid on items that contravene any law;

- customs duties were paid on imported items that were exported thereafter to Namibia, Botswana, Lesotho, or Eswatini.