Introduction to Tariff Codes

The tariff code is the international classification system for imported and exported goods. Virtually all products in global trade have been assigned a unique tariff code, also known as harmonised system (HS) numbers. As the first 6 digits of the code are identical around the world, the various customs departments can communicate more effectively with each other.

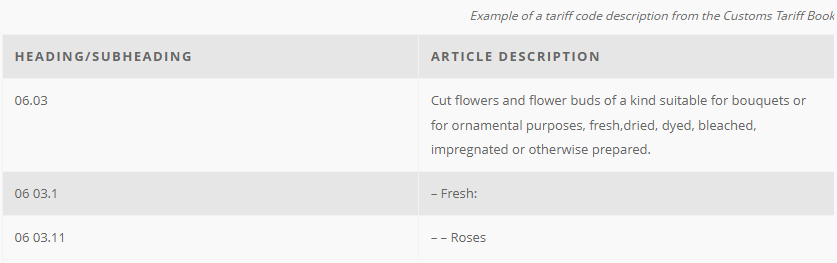

The tariff code ranges from 6 to 10 digits in length. A partial code, representing a wide category of goods, has less than 6 digits. The more digits in a code, the more specific the product it describes. You can see in the example below, taken from the South African customs tariff book, how the product definition on the right becomes more specific as the digit length increases on the left.

Finding the correct tariff code in your country’s particular tariff book enables you to view the import duty tax for that product. This is listed next to the code. Get a copy of the South African tariff reference book here.

Using the correct tariff code is critical, as it relates to the buyer’s duty tax and the regulations on the product. Incorrect coding could have a significant influence on the product’s end cost, could lead to substantial penalties payable at customs and/or delays in clearing customs.

As an importer, the simplest way to get the correct code is to check with your supplier. They would have obtained it, as they must show the correct tariff/HS code on all the export documentation.

As a first-time exporter, or if you want to confirm your code, you could organise to get a professional tariff classification. For exporters from South Africa, this Tariff Lookup guide is available for use by those who know the tariff classification process. It links to the South African tariff book.

The rules around determining accurate codes can be complex. We therefore caution against attempting to do so independently. Rather, we strongly recommend that your tariff/HS code be reviewed by a professional. They are able to defend their determination based on tariff regulations.

Using correct tariff/HS codes is critical to a smooth international trade experience. Make the effort to ensure your tariff/HS code is accurate and rather be safe than sorry!