Completing a EUR.1 Certificate

Are you shipping South African products to Europe or the UK? Your business could benefit from the trade agreements that exist between South Africa and the EU or UK by paying lower import tariffs and duties. The EUR.1 certificate is your ticket to accessing these benefits. The EUR.1 certificate certifies that the goods being exported qualify as being of South African origin and therefore qualify for the beneficial import duties that are part of these agreements.

How to apply for a EUR.1 certificate

Firstly, the South African exporter must register at South African customs under either the EFTA-SACU (European Free Trade Agreement-South African Customs Union), SADC-EU EPA (Southern African Development Community- EU Economic Partnership Agreement) or the SACUM-UK EPA (South African Customs Union, Mozambique and UK economic partnership agreement).

Secondly, apply for the EUR.1 certificate. These come in packs of 10. Contact us via our website or on the number above to order a pack of certificates.

Finally, complete one certificate for each export to a partner country.

How to complete a EUR.1 certificate

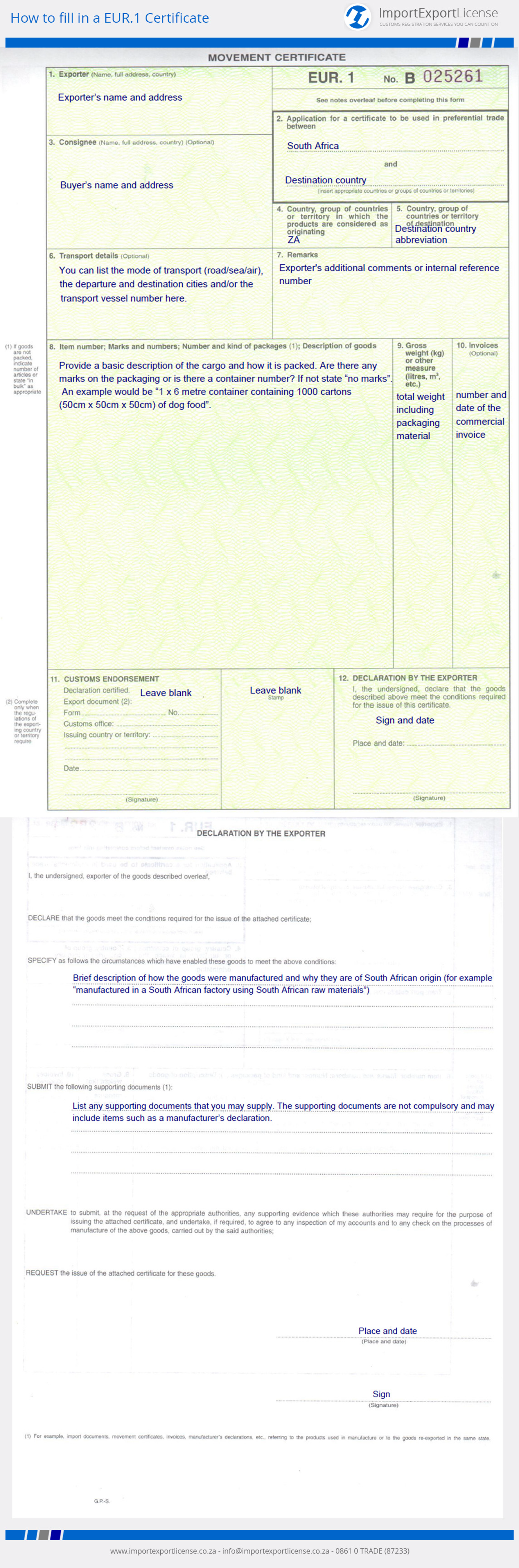

Here is an example of a completed EUR.1 certificate.

Each section of the certificate is numbered, as you will have seen from the examples given above. There are 12 sections.

What follows is a step-by-step guide to fill in each section.

- Section 1: Name, address and customs registration number of exporter

- Section 2: Country of origin (South Africa) and the destination country (country where your exports are being sent)

- Section 3: Name and address of importer (buyer)

- Section 4: The official abbreviation for South Africa (ZA)

- Section 5: The official abbreviation for the destination country

- Section 6: Optional section. This is where you may list the mode of transport (road/sea/air), the departure and destination cities and/or the transport vessel number, e.g. “Airfreight from Johannesburg to Munich” or “Sea freight, MSC Fairweather V 568”.

- Section 7: Optional section. You can provide additional comments and your (the exporter) internal reference number.

- Section 8: Basic description of the shipment and how it is packed. State here if the packaging has any marks. If not, specify “no marks”. Where there is a container number, state this. For example, “3000 cartons (50cm x 400cm x 65cm) of dog food in a 1x 6 metre container. No marks”.

- Section 9: Total weight of the shipment, including the packaging.

- Section 10: Optional section. Give the date and number of the commercial invoice accompanying the shipment.

- Section 11: For official use. Leave this blank.

- Section 12: Exporter signature and date.

- Back Page: A brief description of how the goods were manufactured and proof of origin (i.e. evidence that the products were either wholly or partly manufactured in South Africa). As an example, you could say “manufactured in a South African factory using South African and imported raw materials”). Additionally, list the supporting documents you can supply, e.g. manufacturer’s declaration. These documents are not compulsory. Ensure that you sign and date this page.