A guide to the African Continental Free Trade Area (AfCFTA)

The African Union (AU) implemented the African Continental Free Trade Agreement in May 2019. However, the implementation of its trade benefit was only initiated by South Africa on the 31st of January 2024. Let’s look at what this trade agreement entails, and how it affects South African businesses who import and export.

What exactly is AfCFTA?

It is the largest trade agreement in the world in terms of the number of participating countries and through its promotion of intra-African trade, it holds the promise of boosting Africa’s income. AfCFTA, as an AU flagship project, is not an international organisation in and of itself. It is a member-driven treaty with the shared goal of “improving intra-African trade, integration, and development by establishing an integrated market for goods and services and fostering cross-border mobility of money and persons.” It accomplishes this through autonomous agreements between African member states and customs unions.

Africa has a number of existing customs unions. Member countries of a Customs Union do not individually negotiate terms with AfTFCA, but rather each Customs Union negotiates on behalf of all its member countries. South Africa is part of SACU, the Southern African Customs Union, along with Namibia, Lesotho, Eswatini, and Botswana

What does Customs Union mean?

Also termed a “trade union” or “trade bloc”.

A Customs Union is a multi-country free-trade zone with a single customs policy and external tariff for non-member countries. No customs taxes are due on goods between customs union members.

Trading under AfCFTA

To qualify for trading within the AfCFTA, the agreement stipulates that reciprocal tariff benefits must be provided. This means that only member nations and customs unions that offer preferential import tariffs may benefit from reciprocal decreased duties on their exports under AfCFTA.

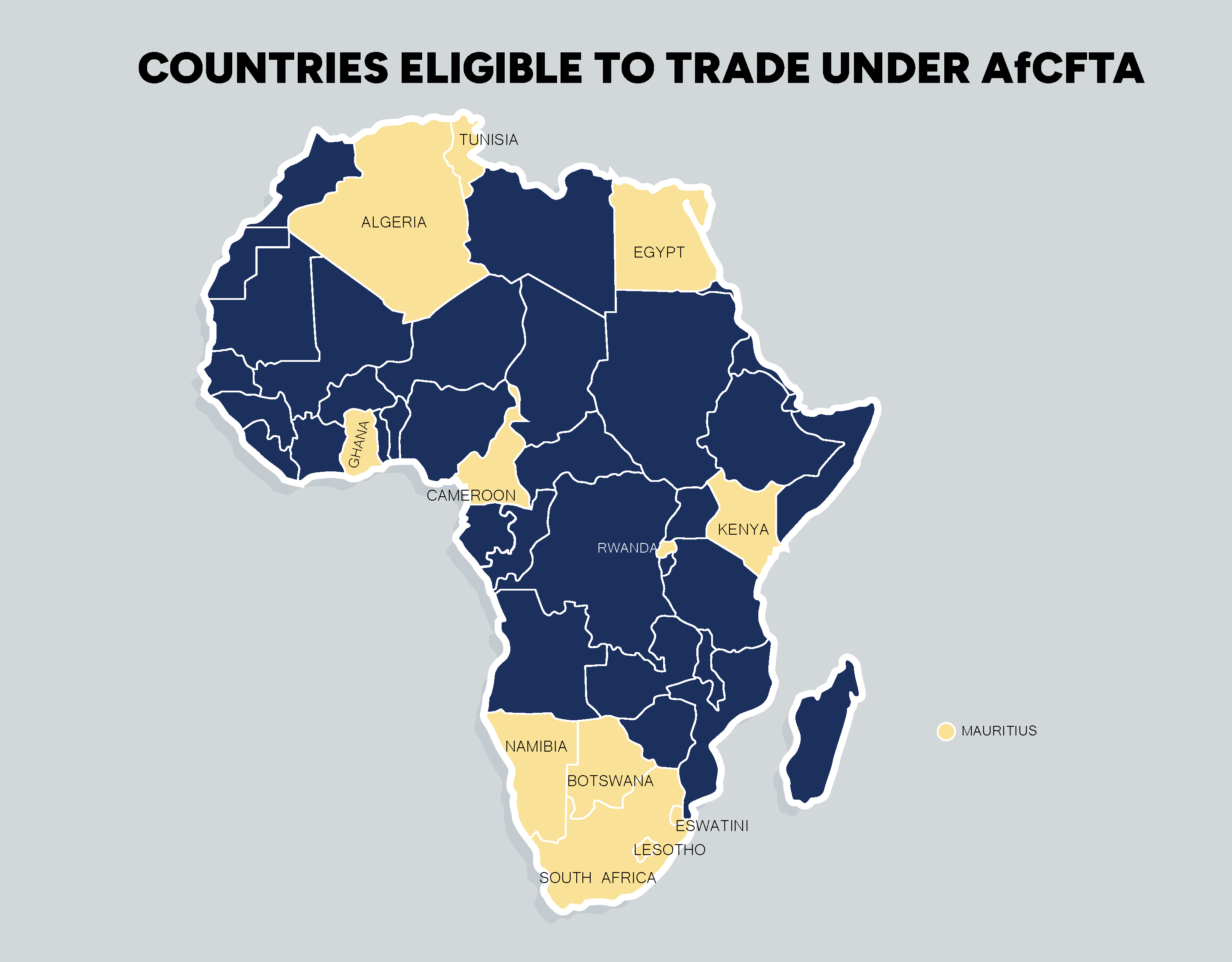

Aside from SACU, the following members have AfCFTA favourable duty rates specified in their tariff schedules:

- Algeria, Cameroon, Egypt, Ghana, Kenya, Rwanda, Tunisia and Mauritius

According to the terms of reciprocity, only imports from these countries into SACU are eligible for tariff benefits, and SACU exports are eligible for advantageous duty rates in these member countries. As trade negotiations conclude, more countries will be added to this list.

Even though the agreement is operational, most of its legislation is still being finalised. This contains the final Rules of Origin for over 88 percent of tariff lines. The rules of origin for the automotive and textile sectors are the only ones that remain unfinished. All existing tariffs and regulations are therefore not the result of concluded discussions and serve as an interim measure. For instance, until SARS can provide an AfCFTA-specific certificate of origin, SADC certificates linked to an AfCFTA registration are adequate.

The implementation requirements

For an AfCFTA member state to engage in trade:

- Negotiations that are still open must be completed.

- Tariff negotiations must yield results (AfCFTA must approve proposed tariff schedules and rules of origin).

- Domestic laws and procedures are required. This includes tariff books that have been revised.

- Tariff books in a customs union, such as SACU, reflect a single external tariff that all members must agree on.

- AfCFTA legislation, tariffs, and rules must be published and made public (gazetted).

AfCFTA parallelism

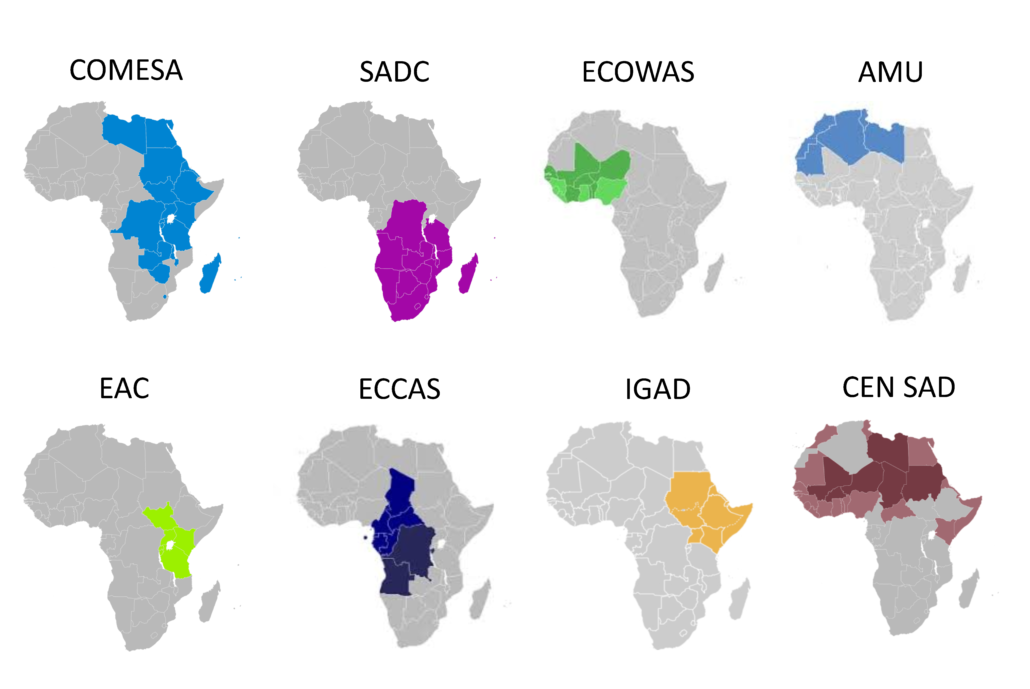

Although AfCFTA recognizes eight existing trade agreements or regional economic communities (RECs), these agreements are neither affected nor supplanted by AfCFTA and continue to exist. Additionally, these institutions have no rights under AfCFTA. Only state parties (member nations and customs unions) have the authority to bargain and offer advantageous duties. There are no long-term plans for AfCFTA to lead to the dissolution of current accords.

What exactly is a trade agreement?

A Trade Agreement is an agreement between two or more countries on how they will collaborate to improve mutual trade. Tariffs, or taxes and charges, that countries place on each other’s imports are determined by these agreements. In general, when countries have a Trade Agreement in effect, commodities flow more easily between them and fewer duty charges are applied.

The following trade treaties are referenced in AfCFTA legislation:

Plans for AfCFTA implementation

The AfCFTA aims are being implemented in two stages:

The first phase focuses on commodities mobility and the five priority service industries, which are financial services, communication, transportation, tourism, and professional services.

In practice, for importers and exporters, phase one entails promoting intra-African trade by eliminating taxes, establishing rules of origin and dispute resolution, and combating non-tariff barriers. Non-tariff barriers include complicated bureaucracy, excessive border delays, corruption, and logistical constraints. AfCFTA has created Trade Barriers Africa, an online tool that traders can use to report non-tariff barriers for examination. The tool can be found here.

The second phase of AfCFTA implementation focuses on investment, competition, and intellectual property, as well as the expansion of African e-commerce.

Eliminating import taxes to permit free trade

Although state parties have the ability to negotiate, the AfCFTA’s minimal requirements for duty reduction and removal are as follows:

- Over a five-year period, 90% of tariff lines must be liberalised (rendered duty-free). This deadline has been extended to 10 years for least developed countries.

- Over the next 10 years, an extra 7% of tariff lines must be liberalised. This deadline has been extended to 13 years for least developed countries.

- Tariff lines of 3% may be exempted from liberalisation to provide members with protection in their most vulnerable markets.

- Tariff reductions must be phased in in equal instalments (20% reduction per year on 90% of tariff lines over five years).

As a result, while we are not currently seeing significant duty benefits on imports in the South African tariff book, we will be soon.

Although the goal of AfCFTA is to facilitate the movement of products, customs laws in the nation of export and the country of import must still be followed. This comprises permits for regulated items and compliance certificates.

South Africa’s role in the implementation of AfCFTA

In February 2023, SACU extended preferential treatment on 90% of the items in its tariff schedule. This offer gained approval from the AU in May 2023, thereby granting SACU countries eligibility for preferential treatment within the AfCFTA framework. On the 31st of January 2024, South Africa became the first SACU country to start trading under AfCFTA. This was commemorated by the departure of two shipments of goods from Durban harbour en route to Ghana and Kenya.

What does this mean for South Africa?

This significant milestone will bring advantages to South African businesses by expanding trade opportunities and opening avenues for economic growth. South Africa can now trade duty-free or with preferential duties in new African markets. South Africa can now engage in duty-free trade or trade with preferential duties in additional African markets. This expansion encompasses AfCFTA members beyond those covered by the SADC trade agreement, such as Algeria, Cameroon, Egypt, Ghana, Kenya, Rwanda, and Tunisia.

What must South African traders do in light of the AfCFTA?

Keep an eye on reliable sources (such as this article) for up-to-date information on nations that offer and allow preferential duties, as well as other AfCFTA implementation news.

Importers can use the South African tariff book to keep track of current AfCFTA tariffs paid on their goods.

Exporters can track AfCFTA implementation in their target countries and anticipate buyer demand to become AfCFTA compliant. In practice, this entails registering as an AfCFTA exporter to provide the requisite certificates of origin required by buyers to claim favourable duties.